When a SaaS company chooses a conservative business model, it’s often a surprise. Vendors that don’t seek big funding rounds and instead opt for a bootstrapped, cashflow-positive option are notable by their exception.

Supermetrics, Hotjar and Mailchimp are all credible examples of successful growth companies that didn’t go for significant raises, yet the reality is that the overwhelming majority of software vendors take on meaningful investment with the primary intention to grow.

Rapid growth means expanding the topline as fast as possible. Even tempered growth will often mean a focus on revenue over EBITDA - competitive marketplaces often dictate that gaining market share quickly is more important than growing cautiously.

So what happens when there is a tighter macroeconomic climate, or targets are missed two quarters in a row? Suddenly the bottom line becomes more of a focus.

Financial leaders scan through costs to look for ways to extend runways and adjust forecasts. Sadly, that typically means making cuts to headcount. In the first six months of 2022 alone, over 500 startups laid off more than 70,000 employees in the SaaS market .

Cutting costs without cutting people

A lot of the costs at startups are fixed. Cloud computing, office space and associated COGS are hard to touch - which is why employees are the obvious target for CFOs looking to reduce expenses. It may be painful, but it’s variable.

An increasing number of SaaS companies are avoiding having to make staff redundancies by instead overhauling their software purchasing process.

Most SaaS businesses rely heavily on SaaS themselves, using a wide variety of products to build, service, sell and scale their operations, regularly creating a Frankenstack of technologies.

What tech firm could realistically support digital-first growth without Slack, Zoom, M365, Salesforce, Hubspot or Workspace? These tools are appealing because they are flexible and agile, but the cost of SaaS can expand rapidly.

The average tech company now spends around $4500 on SaaS per employee, which is around €1 in every €8 spent in total. Tackling this cost base offers an attractive opportunity to cut spend without cutting personnel. So why do so many companies struggle to do so?

The challenge of managing SaaS

It’s hard to reduce SaaS costs. Really hard. That’s because so much of the buying process happens in the dark. Over half of vendors obscure their pricing, so having a benchmark for list pricing becomes difficult.

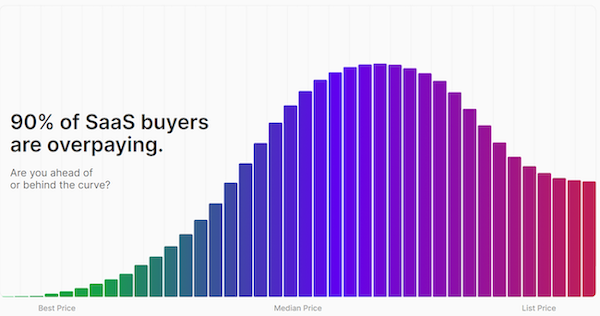

Encouraging prospective customers to speak with the sales team is a common technique, with the intention of the vendor to try and charge as much as possible on a customer-by-customer basis.

Discounting is a widely-accepted practice in SaaS too. Some customers will pay €15 a license while others will pay just €0.50. Getting transparency into what you should be paying is almost impossible.

Ultimately SaaS vendors have designed their business models to maximize their revenue, of course, but the outcome is that customers are not empowered to manage their costs.

There are additional issues further complicating SaaS purchasing. Shelfware and tool duplication are present everywhere - licenses that go unused and multiple products with similar functionality being deployed in different corners of the business.

In order to effectively manage the overall costs of SaaS, it also requires universal visibility of the SaaS stack. This is almost impossible with siloed decision making, Shadow IT and dispersed buying power across finance, IT, department heads and procurement.

How to get the right data to cut SaaS costs by 20%

Reducing the total amount spent on SaaS by a third would amount to a net saving of 5-6% in most startups. That’s a significant financial lever to pull. Yet to be able to pull it, companies need to understand how their SaaS spend compares with others.

While services and products are available to compare functionality, like Gartner or G2, the options for gathering intelligence on pricing is more fragmented. It’s not uncommon to have to crawl through forums and Reddit posts just to get insight into the discounting opportunity during a renewal.

Asking peers and connecting with the wider startup network is another way to drive a more informed negotiation.

Ultimately, however, getting the best possible price for dozens of different SaaS products can quickly become a full time job. New solutions have emerged to fill this gap in recent months, helping startups manage their SaaS costs in a sustainable way.

Vertice, for example, maintains a database of tens of thousands of vendor contracts. This allows its customers to benchmark real pricing data, comparing the actual buying price for thousands of products to the list price - a figure which is also often obscured.

Knowing that a customer with a particular requirement at a particular scale is paying $5 rather than the list price of $10 can help a similar customer renegotiate their $9 renewal.

It also helps to have awareness of the various traits of each vendor, such as auto renewals, price uplifts, economies of scale, bundling, term length, buying centers, time of year and more.

Zero risk approach to cutting SaaS costs

Combining pricing insights with a deep knowledge of the SaaS industry changes the balance in contract negotiations for customers, and helps startups save 20-40% on their total SaaS spend. Vertice even offers its customers a savings guarantee, meaning organizations will dramatically cut their SaaS costs or get their money back.

Want to boost your skills for maximum growth? Get segmentation certified here!